If you’ve ever thought about buying or selling a home, you’ve probably asked yourself, “How much is this going to cost?"

If you’re a broker hiring agents for your team, you’ve probably asked yourself, “What’s the fairest, and most attractive, way to pay my agents so that they want to stay—and so I can keep the lights on?”

If you’ve sold your home and looked at how much of the sales price goes towards commissions, you’ve probably wondered, “Was it worth it?”

There are a lot of people who don’t know the ins and outs of real estate commissions, and yet they’re one of the backbones of the industry. Our essential guide demystifies real estate commissions once and for all and answers all the commissions questions (even some you may not have thought of before).

Table of Contents

- How do realtors get paid?

- What is the difference between a broker, agent, and realtor?

- How much are real estate agent commissions?

- Do real estate agents make too much money?

- How is a real estate agent’s commission split with a broker?

- What are the most common ways to split commissions?

- Fixed commission splits

- Graduated commission splits

- Graduated commission rollbacks

- Graduated commission caps

- 100% commission splits

- What’s the best commission split?

How do realtors get paid?

Most real estate agents are paid through commissions.

The vast majority of real estate agents are independent contractors who work under a broker, who maintains the necessary licenses and ensures transactions are completed in accordance with the law and that all funds exchanged during the transaction are properly recorded.

What is the difference between a broker, agent, and realtor?

| Broker | Agent | Realtor |

| Real estate agents who continue their education and successfully receive a state real estate broker license. Unlike real estate agents, brokers can work independently and start their own brokerage and hire other real estate agents. | Individuals who are licensed to help people buy, sell, and rent real estate. They are ultimately responsible for bringing buyers and sellers together and are paid a commission—usually a percentage of the property's sale price. | A Realtor is a real estate professional who is a member of the National Association of Realtors (NAR), the largest trade association in the U.S. |

Source: Investopedia

How much are real estate agent commissions?

By law, real estate agent commissions are negotiable. Consumers should not feel pressured to pay more than they are comfortable with. The typical commission is usually around 6% of the sales price. Consumers may find a good agent who is willing to work for less than 6%, and lowering the percentage by half a percentage point (or even a whole percentage point) can be an effective way to earn a listing. However, consumers should keep in mind that they often get what they pay for, and an agent who is willing to accept an exceptionally low commission percentage will likely not work very hard or be the best representative of the buyer or seller’s interests in the transaction.

In most cases, the buyer-side and seller-side agents split the commission from the sale of a property 50/50. This means that 3% of the sales price goes to the buyer’s agent and 3% goes to the seller’s agent.

Where it starts getting really interesting (and complicated) is how the commission is split between an agent and their brokerage. More on that below.

Who pays real estate agent fees?

In most cases, the commission is taken out of the seller’s proceeds (the amount after any applicable claims, taxes, or other liabilities are deducted) after their property sells. Buyers are not usually responsible for paying these fees, but this is also negotiable.

Do real estate agents make too much money?

The answer to this question depends on whom you ask.

In truth, most real estate agents do not sell very many houses. The average agent participates in one transaction per month, or about 12 per year, resulting in median gross income of $54,330 in 2021, according to NAR. Considering how hard most real estate agents work, this seems like it is well worth it. Plus, most real estate agents are also independent contractors and have significant expenses associated with their work, including continuing education requirements to keep their licenses current.

How is a real estate agent’s commission split with a broker?

This is where commissions start getting really interesting.

There are about as many different ways to split an agent commission as there are brokerages. In other words, every brokerage in the country could potentially do things differently.

What are the most common ways to split commissions?

Even though there is an infinite number of commission possibilities, there are three main categories that commission splits tend to fall into: fixed, graduated, and 100%. Let’s explore them below.

Fixed commission splits

In North America, fixed commission splits are by far the most common way to divvy up commissions between brokers and agents. Since they’re called “fixed,” split does not change, no matter how many deals an agent closes or how much money is associated with those deals. Depending on the type of brokerage and the market, fixed commission splits generally fall between 50/50 and 70/30. The first number is the percentage of the commission the agent gets to keep and the second is the percentage that goes to the broker. To better illustrate this idea, here’s an example:

Fixed commission splits mean both agents and brokers receive the same percentage from every transaction until they renegotiate the terms of their relationship, either by changing percentages or changing commission plans altogether. The result is more predictable income for all the parties involved. According to the NAR, in 2020, 37% of agents received a fixed commission split.

Fixed commission plans are an advantageous arrangement for full-service brokerages (that provide everything their agents need, from training to printing to office space, for free) and smaller brokerages with fewer agents. Brokerages have a lot of overhead, especially if they’re leasing premium office space and providing tools like a CRM, digital marketing suite, website, and sharing leads with agents. When the agent count is small, brokerages need cash coming in to cover their expenses and turn a profit, which is easier with a higher fixed split. Fixed splits also reduce administrative and accounting hassle. Agents take their share, which is always the same percentage of the total, and then the broker keeps theirs. There are no tiers to keep track of, no sliding scales, no extra fees, and no anniversary dates. Pretty simple!

Graduated commission splits

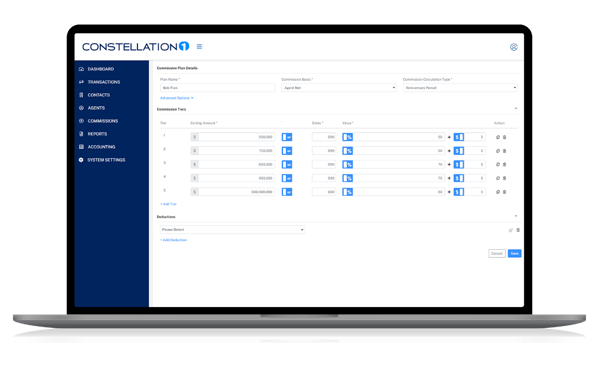

Graduated commissions are much like fixed commissions but change according to a sliding scale. The more revenue an agent brings in, the more of their commission they get to keep. For example, a broker might start an agent at a 50/50 split until they earn $25,000 in commission income. Then, your agent’s percentage increases to 60% for income up to $40,000, and then to 80% for all commissions after that. According to the NAR, in 2020, 23% of agents were paid using a graduated commission split.

Depending on the market and the potential for higher commissions, brokers can use graduated commission splits to recruit and retain high performers more easily because they will be attracted to the prospect of keeping a greater percentage of their commissions for themselves after making more sales.

Graduated commission rollbacks

Graduated commissions have a unique feature that fixed commissions do not called rollbacks. A rollback is the practice of resetting an agent’s commission graduated commission percentage back to the “starting” amount once per year, either on January 1 or on the agent’s anniversary date.

Graduated commission caps

Brokers might also choose to cap commissions at a certain amount. This is another unique feature of graduated commissions. When commissions are capped, agents pay the graduated split until they reach the cap, then get to keep 100% their commissions after that. According to the NAR, in 2020, 15% of agents received a capped commission split. This can be very motivating for agents, because they will work hard to reach the point where they can keep their full commission. Brokers with caps need to be careful that they don’t run out of cash flow, though, especially if their team is small and everyone hits their cap in October (three months with no commission income could be tough!).

100% commission splits

Brokerages that use a 100 percent commission plan let agents to keep the full amount of their commissions on every sale. Rather than generating revenue through commissions, they charge various fees for the products, services, and benefits they provide. Agents on a 100% commission plan (which is sometimes called a rent-a-desk arrangement) pay their brokers for all the brokerage services they use. These might include:

- Desk fee: A flat monthly fee for a desk at the brokerage’s office

- Equipment fee: A flat monthly fee for internet, phones, copiers, etc.

- Administrative fee: One-time or flat fees to cover getting set up in the brokerage’s system and recurring expenses like transaction record management, etc.

- Transaction fee: A flat fee added at closing.

- Insurance fee: A monthly fee applied towards E&O insurance or other professional liability insurance.

- Support fee: A fee charged for support or mentorship from the broker or trainers hired by the brokerage.

Agents pay for what they need when they need it, but brokerages also get a steady and predictable flow of cash from recurring flat monthly fees, the amount of which is determined based on operating expenses and desired margins.

What’s the best commission split?

There is no right answer to this question, because different splits all have their own pros and cons. The good news is that brokers may decide to pay different agents different commission splits as well, according to agent experience, seniority, and personal preference, as well as the needs and priorities of the brokerage. New brokerages need to maximize cash flow, so a 100% commission plan might be best, but brokerages also need to attract top talent, and they might be more attracted by a graduated commission split. The beauty is that brokers aren’t forced to choose: they can have as many unique commission plans as they want, provided they have an easy way to manage them.